Browse

Courses

Books

Prime Test

Previous Year Paper

Offline Batch

Test Pass

Current Affairs

Timetable

Free Quiz

Syllabus

Job Alerts

Weekly Test

Social Links

Ebooks

Featured

ESI - ECONOMICS & SOCIAL ISSUES

₹8,999

₹5,999

Banking & Financial Awareness

₹8,999

₹5,999

General Management

₹8,999

₹5,999

Testimonials

Sunderpal Dahiya

The Exam Prepp app is a game-changer for students and professionals preparing for competitive exams like RBI Grade B, SEBI, NABARD, and banking promotional exams such as DBF, JAIIB, and CAIIB. Here's why: Comprehensive Course Offerings: The app offers a wide range of free courses, covering crucial subjects like Finance, Management, General Awareness, and ESI. It's a one-stop solution for aspirants.

tarun

"I had an excellent experience preparing for the RBI Grade B exam with this App! The study material was comprehensive, covering every topic in detail, and the mock tests were spot-on in simulating the actual exam. The current affairs section was updated regularly, and the faculty's guidance was invaluable. Their teaching approach and strategies for cracking the exam were incredibly helpful. Highly recommended for anyone serious about clearing RBI Grade B!"

Nisha

this App is really very Helpful for sharpen the preparation....level of mock questions are Helpful to improving the score of my preparation..I would suggest to All for downloading it n embrace ur journey of preparation through it...✌️

Bhawana Karki

good

Gurdayal Singh

Better Content Delivery by Sunderpal Sir for All Banking Exams and RBI.

Isha Jaint

Sir is so hardworking each content is best that he provides to us best app ever

Kshitij Chirwatkar

Best content delivery with efficiency...

KRISHNENDU BERA

excellent

simranjeet Kaur

Best for preparation of government exams

Sunderpal Dahiya

The Exam Prepp app is a game-changer for students and professionals preparing for competitive exams like RBI Grade B, SEBI, NABARD, and banking promotional exams such as DBF, JAIIB, and CAIIB. Here's why: Comprehensive Course Offerings: The app offers a wide range of free courses, covering crucial subjects like Finance, Management, General Awareness, and ESI. It's a one-stop solution for aspirants.

tarun

"I had an excellent experience preparing for the RBI Grade B exam with this App! The study material was comprehensive, covering every topic in detail, and the mock tests were spot-on in simulating the actual exam. The current affairs section was updated regularly, and the faculty's guidance was invaluable. Their teaching approach and strategies for cracking the exam were incredibly helpful. Highly recommended for anyone serious about clearing RBI Grade B!"

Nisha

this App is really very Helpful for sharpen the preparation....level of mock questions are Helpful to improving the score of my preparation..I would suggest to All for downloading it n embrace ur journey of preparation through it...✌️

Bhawana Karki

good

Gurdayal Singh

Better Content Delivery by Sunderpal Sir for All Banking Exams and RBI.

Isha Jaint

Sir is so hardworking each content is best that he provides to us best app ever

Kshitij Chirwatkar

Best content delivery with efficiency...

KRISHNENDU BERA

excellent

simranjeet Kaur

Best for preparation of government exams

Sunderpal Dahiya

The Exam Prepp app is a game-changer for students and professionals preparing for competitive exams like RBI Grade B, SEBI, NABARD, and banking promotional exams such as DBF, JAIIB, and CAIIB. Here's why: Comprehensive Course Offerings: The app offers a wide range of free courses, covering crucial subjects like Finance, Management, General Awareness, and ESI. It's a one-stop solution for aspirants.

tarun

"I had an excellent experience preparing for the RBI Grade B exam with this App! The study material was comprehensive, covering every topic in detail, and the mock tests were spot-on in simulating the actual exam. The current affairs section was updated regularly, and the faculty's guidance was invaluable. Their teaching approach and strategies for cracking the exam were incredibly helpful. Highly recommended for anyone serious about clearing RBI Grade B!"

Nisha

this App is really very Helpful for sharpen the preparation....level of mock questions are Helpful to improving the score of my preparation..I would suggest to All for downloading it n embrace ur journey of preparation through it...✌️

Bhawana Karki

good

Gurdayal Singh

Better Content Delivery by Sunderpal Sir for All Banking Exams and RBI.

Isha Jaint

Sir is so hardworking each content is best that he provides to us best app ever

Kshitij Chirwatkar

Best content delivery with efficiency...

KRISHNENDU BERA

excellent

simranjeet Kaur

Best for preparation of government exams

Sunderpal Dahiya

The Exam Prepp app is a game-changer for students and professionals preparing for competitive exams like RBI Grade B, SEBI, NABARD, and banking promotional exams such as DBF, JAIIB, and CAIIB. Here's why: Comprehensive Course Offerings: The app offers a wide range of free courses, covering crucial subjects like Finance, Management, General Awareness, and ESI. It's a one-stop solution for aspirants.

tarun

"I had an excellent experience preparing for the RBI Grade B exam with this App! The study material was comprehensive, covering every topic in detail, and the mock tests were spot-on in simulating the actual exam. The current affairs section was updated regularly, and the faculty's guidance was invaluable. Their teaching approach and strategies for cracking the exam were incredibly helpful. Highly recommended for anyone serious about clearing RBI Grade B!"

Nisha

this App is really very Helpful for sharpen the preparation....level of mock questions are Helpful to improving the score of my preparation..I would suggest to All for downloading it n embrace ur journey of preparation through it...✌️

Bhawana Karki

good

Gurdayal Singh

Better Content Delivery by Sunderpal Sir for All Banking Exams and RBI.

Isha Jaint

Sir is so hardworking each content is best that he provides to us best app ever

Kshitij Chirwatkar

Best content delivery with efficiency...

KRISHNENDU BERA

excellent

simranjeet Kaur

Best for preparation of government exams

About Us

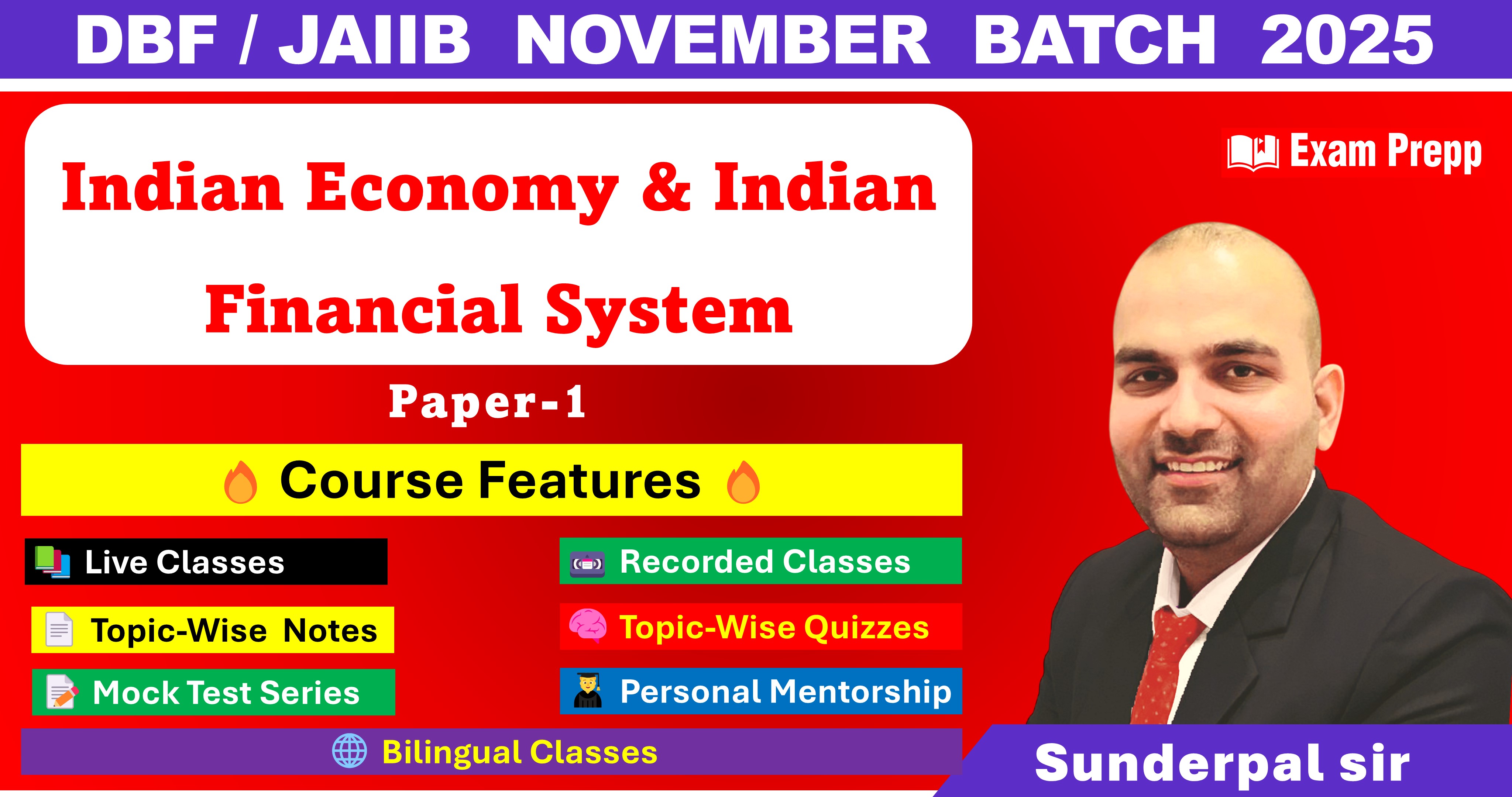

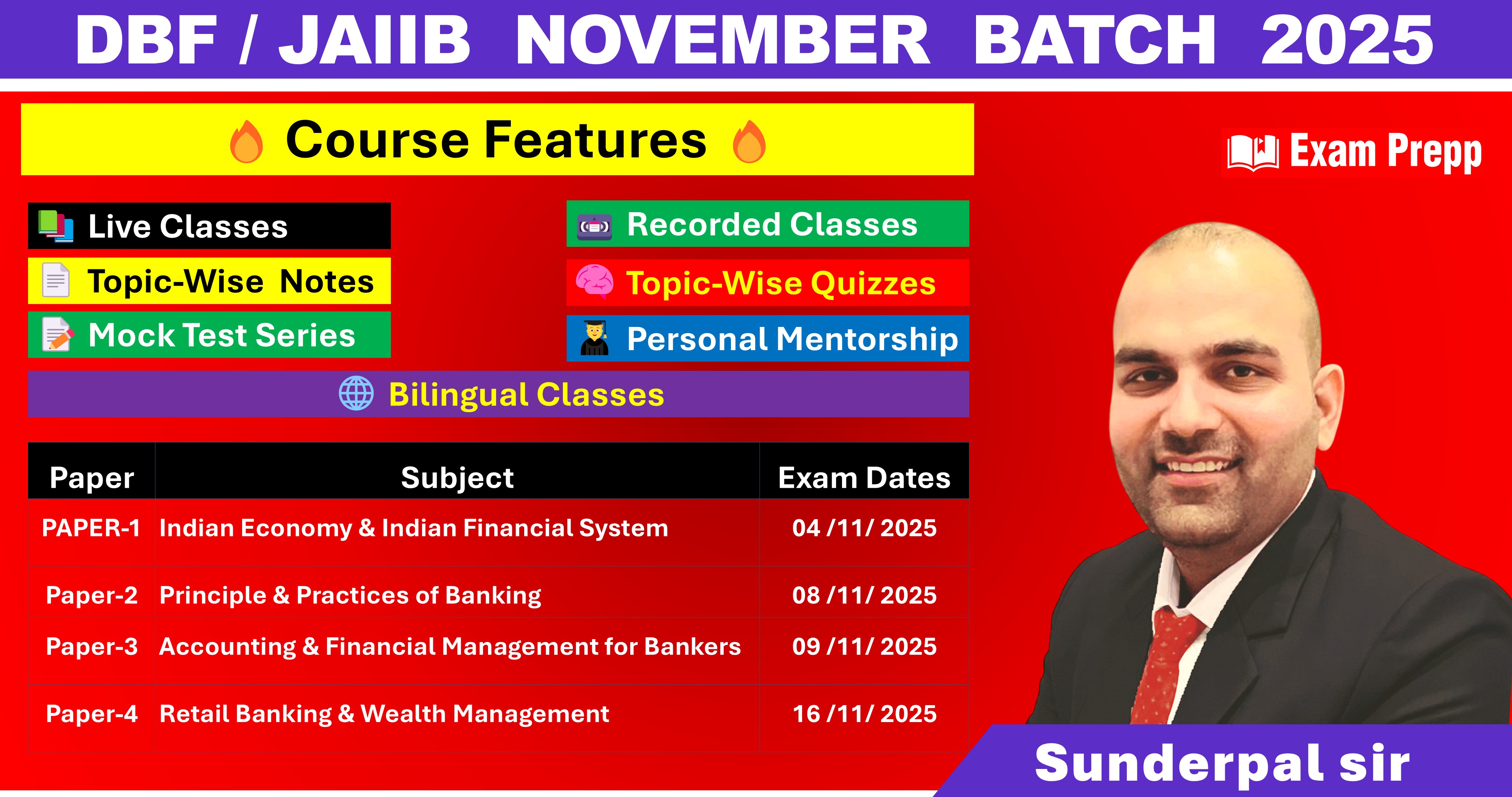

At Exam Prepp, we believe that success is not just about passing an exam—it’s about building a future. Founded by Sunderpal Dahiya, an educator with 8 years of experience and a legacy of teaching at Delhi’s top coaching institutes, we are committed to transforming aspirants into accomplished professionals.

With structured learning, expert guidance, and a results-driven approach, we help you navigate your journey with confidence. Whether you're aiming for career growth or a competitive edge, Exam Prepp is your trusted companion in achieving excellence.

Join us and turn your aspirations into reality!