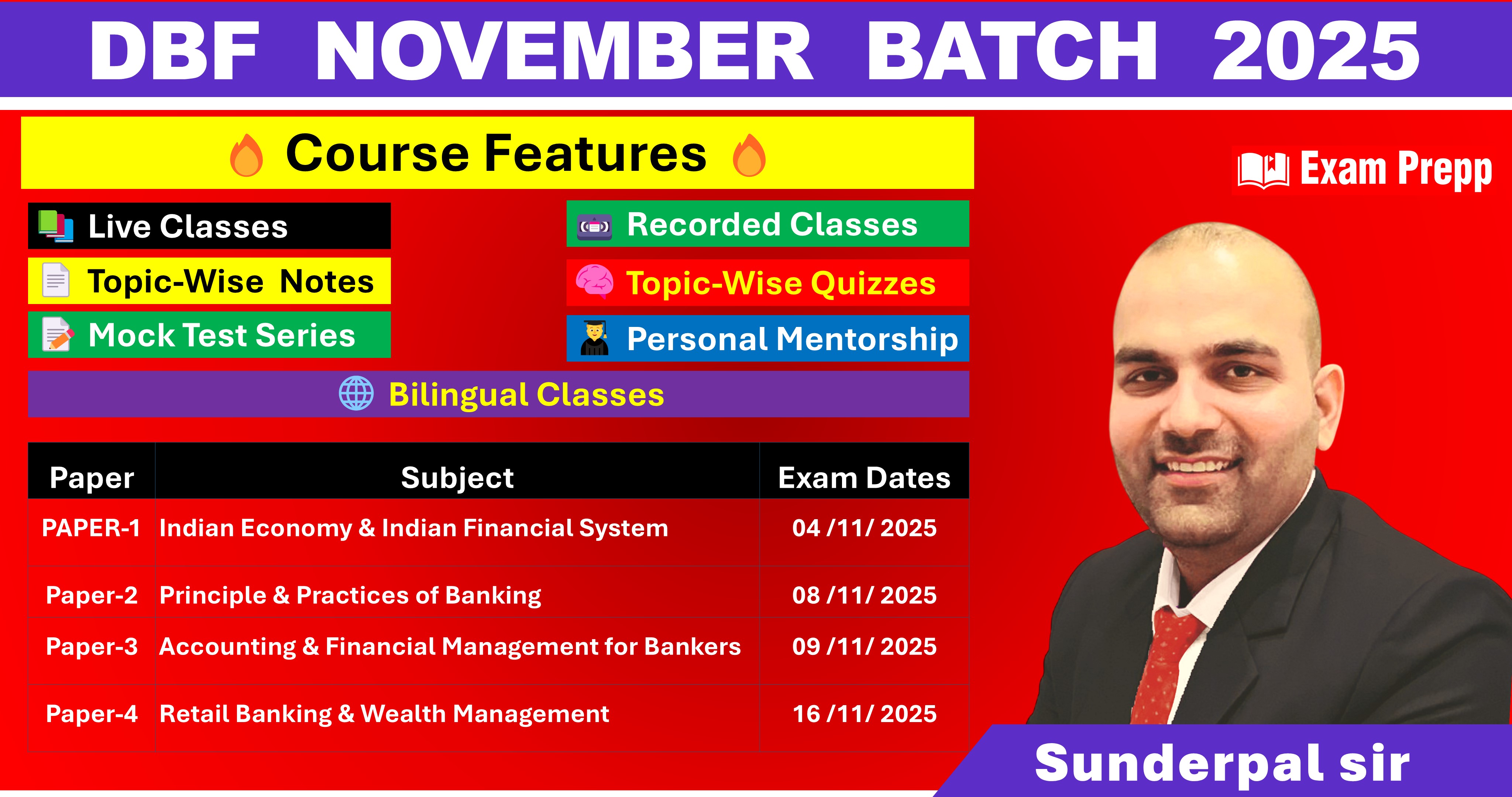

DBF -NOVEMBER 2025

Validity: 6 Months

₹8,999

₹25,000

Choose Currency:

Features

- Topic-wise & Class-wise Quizzes.

- PDF Class Notes after each class.

- Test Series for the Subject Included.

- Extra Doubt-Solving Sessions.

- One-on-One Mentorship: Personalized guidance and mentorship to address your unique learning needs and goals.

Description

DBF November 2025 - Bilingual Video Course (English Content + Hinglish Explanation)

Course Overview

This comprehensive video course is designed for banking professionals preparing for the DBF November 2025 attempt. The course covers all four subjects as per the latest IIBF syllabus, ensuring a structured and effective learning experience.

- Bilingual Mode: Content in English, Explanation in Hinglish

- Complete Syllabus Coverage: All four subjects included

- Flexible Learning: Recorded premier classes + Live doubt-solving sessions

- Study Materials: PDF notes, quizzes, and chapter-wise MCQs for practice

Subjects Covered & Module Breakdown

1. Indian Economy & Indian Financial System (IE & IFS)

- Module A: Indian Economic Architecture

- Module B: Economic Concepts Related to Banking

- Module C: Indian Financial Architecture

- Module D: Financial Products and Services

2. Principles and Practices of Banking (PPB)

- Module A: General Banking Operations

- Module B: Functions of Banks

- Module C: Banking Technology

- Module D: Ethics in Banking and Financial Sector

3. Accounting & Financial Management for Bankers (AFM)

- Module A: Accounting Principles and Process

- Module B: Financial Statements and Core Banking Systems

- Module C: Financial Management

- Module D: Taxation and Fundamentals of Costing

4. Retail Banking & Wealth Management (RBWM)

- Module A: Introduction to Retail Banking

- Module B: Retail Products and Recovery Process

- Module C: Marketing of Banking Services and Wealth Management

- Module D: Role of Technology in Retail Banking

Course Features & Benefits

✅ Structured Learning Approach

- Topics are broken down into smaller segments for easy understanding.

- Utilize your ideal time efficiently with bite-sized lessons.

✅ Blended Learning Model

- Recorded Premier Classes: All classes are recorded and premiered at the batch time.

- Live Doubt Sessions: Conducted whenever needed for better concept clarity.

✅ Comprehensive Study Resources

- PDF Notes: Provided after each class for quick revision.

- Chapter-wise MCQs: For thorough exam preparation.

- Quizzes for Each Topic: Reinforce learning after every class.

- Concept-Based Chapter Theory: Detailed explanations of every topic.

✅ Flexible & Exam-Oriented Preparation

- Study anytime, anywhere with recorded classes.

- Regular assessments to track your progress.

- Designed to ensure conceptual clarity and exam success.

Why Choose This Course?

✔️ Covers the latest syllabus of DBF November 2025

✔️ Bilingual teaching (English content + Hinglish explanation)

✔️ Smart topic division to utilize ideal time effectively

✔️ Live doubt-solving when required

✔️ Study materials, quizzes, and MCQs for revision

Get ready to crack DBF in your first attempt with this well-structured and engaging course! Join now!